Overview: Market Trends, Technological Innovations, and Insights into OEM Partnerships

Orthopedic implant manufacturing is entering a new era of transformation. From personalized medicine and smart implant technology to sustainable production and precision machining, the global medical industry is rapidly advancing toward higher quality and greater accuracy. This article explores the latest trends and market developments, including 3D printing, artificial intelligence, breakthroughs in new materials, and regulatory challenges. It also discusses how stainless steel, titanium, and PEEK are utilized in orthopedic manufacturing, providing valuable insights for manufacturers and procurement professionals as they plan for the future.

As medical technology advances, the manufacturing of orthopedic implants is reaching a significant milestone. Every aspect of the process,from product design and material selection to manufacturing and quality control,is evolving and reshaping the industry. Future implants are expected to go beyond merely restoring physical function; they must deliver precision, safety, and sustainability, helping patients recover more quickly and improve their overall quality of life.

Table of Contents

-

Global Orthopedic Implant Market Outlook: Growth Forecast and Key Drivers from 2025 to 2032

-

The New Standard in Custom Manufacturing: A Comprehensive Process from Design to Production

-

Applications of AI Technology in Orthopedic Implant Design and Surgical Planning

-

Global Market Analysis: Regional Growth Opportunities and Emerging Trends

-

Conclusion: Advancing Medical Device Manufacturing Through Innovation and Sustainability

-

1. Global Orthopedic Implant Market Outlook: Growth Forecast and Key Drivers from 2025 to 2032

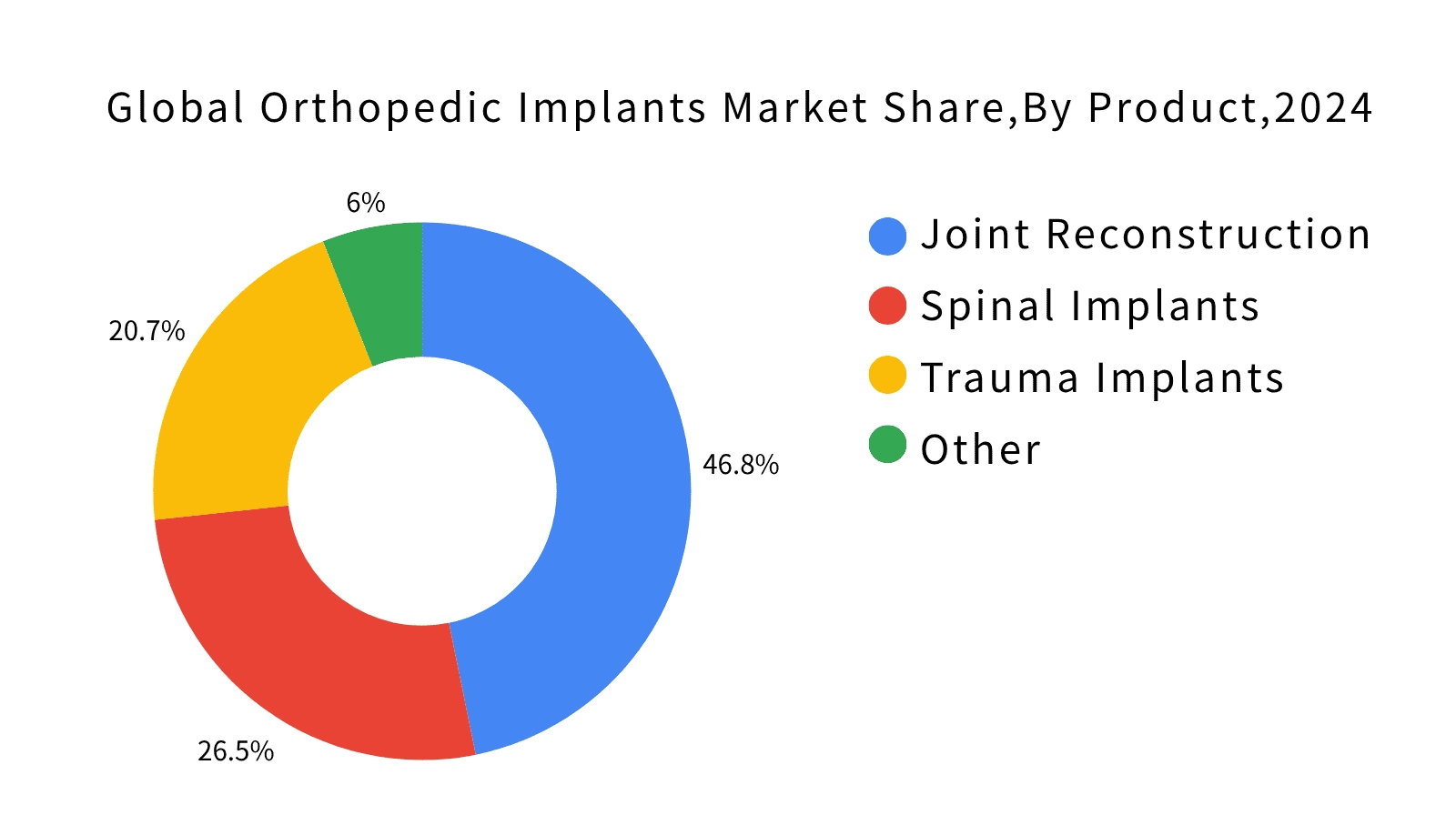

When examining the future of the orthopedic implant industry, the data speaks for itself. According to the 2024 report by Fortune Business Insights, the global orthopedic implant market is projected to grow from USD 49.73 billion in 2025 to USD 71.74 billion by 2032, representing a compound annual growth rate (CAGR) of 5.4%. This steady upward trend is driven by three key factors: the rapid aging of the population, the increasing prevalence of orthopedic conditions, and continuous advancements in medical technology.

One of the most notable trends is the rapid rise of the Asia-Pacific region, which is beginning to outpace growth in the United States and Europe. Taiwan, in particular, is emerging as a key manufacturing hub, with experienced medical device OEMs actively expanding into high-end product development, such as artificial joints and spinal fixation systems. These manufacturers possess deep expertise in precision machining of medical-grade titanium, including Ti-6Al-4V, and are also advancing their capabilities in PEEK applications. From hip and knee replacements to next-generation composite materials, Taiwan’s OEM manufacturing capabilities are undergoing a comprehensive upgrade.

This market growth sends a clear message to medical device brands seeking strategic partners: selecting a manufacturer with comprehensive technical capabilities and a proven quality management system is not merely an option; it is a crucial factor for maintaining a competitive edge in the market.

Figure 1. Global Orthopedic Implant Market Share by Product Category (2024). Source: Fortune Business Insights, 2024.

1The Impact of Minimally Invasive Surgery on Implant Design

Advancements in minimally invasive surgery are revolutionizing the design of orthopedic implants. Traditionally, hip replacement surgery required an incision of approximately 20 centimeters. Today, minimally invasive techniques enable surgeons to perform the procedure through an incision smaller than eight centimeters. This shift in surgical approach is driving the evolution of implant design to address new clinical requirements.

Take artificial hip joints as an example. Traditional implant designs were too large and had fixed angles, making it difficult to insert them through a small incision. Today, medical device manufacturers must rethink the shape and configuration of every component to enable accurate insertion and positioning within a smaller surgical space. The same trend applies to spinal fixation systems. With modular designs and specialized insertion instruments, average surgery time has been reduced by approximately 40 percent, and blood loss has significantly decreased.

In terms of material selection, the combined use of PEEK and medical-grade titanium (Ti-6Al-4V) offers the advantages of both materials. This composite design maintains structural strength while enhancing radiolucency, allowing surgeons to clearly monitor the implant site during postoperative imaging. Clinical studies indicate that patients undergoing minimally invasive surgery experience significant recovery benefits. The average hospital stay has decreased from five to seven days to just two to three days, and reported pain levels have been reduced by nearly half.

For Taiwanese medical device manufacturers, mastering the design and production of minimally invasive implants has become a crucial competitive advantage. Although minimally invasive surgery may seem to simplify procedures, it actually demands higher standards of manufacturing precision and material performance. This trend challenges manufacturers' expertise in engineering design and quality control, and only those with advanced technical capabilities will be able to meet the increasing market demand.

2Green Manufacturing for ESG Compliance: Increasing Material Utilization from 60% to 80%

Sustainable manufacturing is no longer merely a component of a company's brand image; it has become an essential requirement in supply chain management. An increasing number of international medical organizations now mandate that suppliers provide carbon footprint reports and environmental management certifications. This rising expectation is transforming the entire ecosystem of orthopedic implant manufacturing.

In real-world manufacturing, sustainability is integrated into every stage of production. For example, in the processing of medical-grade titanium, traditional cutting of Ti-6Al-4V generates significant metal waste and coolant discharge. Today, leading manufacturers are adopting closed-loop cooling systems that achieve wastewater recovery rates exceeding 85 percent. Through advanced CNC programming, material utilization has increased from 60 percent to nearly 80 percent. Additionally, some state-of-the-art facilities have installed solar power systems that supply approximately 30 percent of the electricity used in artificial joint production lines. The annual carbon reduction achieved by these systems is equivalent to planting five thousand trees.

For medical brands evaluating OEM partners, sustainable manufacturing has become a crucial selection criterion. Key areas of assessment include wastewater recovery systems, improvements in material utilization, and the management of chemical substances during PEEK processing or spinal implant manufacturing. These environmental measures go beyond regulatory compliance; they also demonstrate a manufacturer's commitment to long-term responsibility and sustainable production. As sustainability becomes a baseline requirement, true differentiation will come from advancements in material technology and innovation in manufacturing processes.

2. Three Key Innovations Shaping Orthopedic Manufacturing: Ushering in a New Era of 3D Printing and Smart Implants

The orthopedic implant market is rapidly transitioning from a product-driven model to a manufacturing-driven model. Global brands are no longer seeking OEM factories that merely produce components; instead, they are looking for partners who can contribute to product design, material selection, simulation analysis, and digital manufacturing processes. This shift indicates that OEM manufacturers are evolving from passive executors to collaborative technology developers. Manufacturing capability is becoming a critical factor in the global supply chain.

In this transformation, three technologies have emerged as the primary drivers of orthopedic manufacturing.

- 3D printing is facilitating personalized and small-batch production, transforming traditional machining processes.

- Robotic-assisted surgery is enhancing implant accuracy and directly impacting product design and manufacturing specifications.

- Smart implant technology is incorporating data feedback systems, necessitating that manufacturers integrate electronic components with advanced biomaterials.

The following sections will explain how each of these technologies is transforming manufacturing workflows and reshaping the OEM partnership model. They will also explore the tangible impact on product development, clinical outcomes, and market competitiveness.

1How 3D Printing Is Revolutionizing the Manufacturing and Reconstruction of Orthopedic Implants

3D printing, also known as additive manufacturing, is rapidly revolutionizing the development process of medical implants. Previously, it could take several weeks or even months to progress from design to a physical prototype. With 3D printing, a customized implant can now be produced in as little as two days, significantly reducing development and manufacturing time. This technology enables surgeons and manufacturers to collaborate in real time, transforming concepts into functional products almost immediately and making the idea of "design-to-production on demand" a reality in the medical field.

Unlike traditional subtractive machining, 3D printing can precisely fabricate complex and functional structures. For example, spinal fusion cages can be printed with internal porous architectures that support natural bone ingrowth, enhancing implant stability and promoting healing. This technology also significantly improves material efficiency. In the case of artificial hip cups, conventional manufacturing methods can waste more than half of the material. With 3D printing, material utilization can reach up to 95 percent, reducing costs and supporting sustainability goals. This is especially important when working with expensive medical-grade titanium.

In clinical practice, 3D printing has significantly advanced complex bone reconstruction. For patients experiencing bone loss due to tumor removal or severe trauma, surgeons can utilize CT imaging to design implants that precisely match the patient's anatomy. These implants are fabricated from biocompatible materials such as titanium or PEEK, enhancing surgical accuracy and reducing operating time by 20 to 30 percent, which facilitates faster patient recovery. Additionally, some manufacturers have developed composite printing technologies that combine PEEK with metal to produce artificial joints offering both flexibility and strength, further improving patient mobility and comfort.

Overall, 3D printing is not merely a tool for enhancing manufacturing efficiency; it signifies the dawn of a new era in personalized medical treatment. For manufacturers, this technology has progressed beyond the experimental phase and is evolving into a mainstream market necessity. Companies must integrate design expertise, engineering capabilities, and medical knowledge, alongside rigorous post-processing and quality validation procedures. In the future, mastering 3D printing design principles and manufacturing integration will become a critical prerequisite for entering the high-end medical market.

2Robotic-Assisted Surgery: Enhancing Surgical Precision and Patient Confidence

Modern orthopedic surgery has entered a new era of precision medicine. Surgeons no longer rely solely on experience and manual techniques. With the widespread adoption of 3D navigation and robotic-assisted systems, they can now view real-time 3D images of a patient's anatomy and track every movement with exact angles and depth. These technologies enable implant placement accuracy within one millimeter, enhancing surgical stability and predictability. Consequently, orthopedic surgery is evolving from an experience-based practice into a precise, data-driven science.

Modern orthopedic surgery has entered a new era of precision medicine. Surgeons no longer rely solely on experience and manual techniques. With the widespread adoption of 3D navigation and robotic-assisted systems, they can now view real-time, three-dimensional images of a patient's anatomy and track every movement with exact angles and depth. These technologies enable implant placement accuracy within one millimeter, enhancing surgical stability and predictability. Consequently, orthopedic surgery is evolving from an experience-based practice into a precise, data-driven science.

Surgical robots have become active assistants to surgeons. Before the procedure, these systems can simulate the entire surgery using imaging data. They analyze bone structure, muscle tension, and load distribution to help surgeons plan the optimal implant angle. During the operation, the system continuously monitors for deviations and enhances the precision of each movement. Studies have shown that patients treated with robotic-assisted surgery experience recovery times that are 20 to 30 percent faster and regain mobility more quickly.

The development of these technologies is driving a transformation in implant manufacturing. Product design now must be integrated with navigation and robotic systems. For example, titanium implants may require surface markers recognizable by surgical navigation tools, while PEEK materials are used to enhance imaging visibility during surgery. Although these features increase design and manufacturing complexity, they also create new opportunities for manufacturers to enter the precision medicine market. In the future, orthopedic surgery will no longer be a simple joint replacement procedure; it will result from advanced integration among surgeons, robotic systems, and implant materials, delivering safer and more efficient treatment experiences for patients.

3The Development of Smart Implants: Advances in Sensing Technology and Real-Time Monitoring Applications

Smart orthopedic implants are revolutionizing traditional treatment models. The latest generation of joint replacements and spinal systems incorporates miniature sensing technology, transforming implants from passive fixation devices into active transmitters of real-time physiological data. For example, sensors in knee implants can monitor load distribution across the joint and provide early warnings of potential loosening. In spinal fixation systems, temperature sensors detect signs of infection, enhancing the effectiveness of postoperative monitoring.

Clinical studies indicate that implants equipped with sensing capabilities can improve early detection of complications by approximately 40 percent. This enables physicians to intervene before symptoms worsen, thereby enhancing patient recovery outcomes. The value of smart implants extends beyond mere data collection; they improve clinical decision-making, prolong the lifespan of the implant, and facilitate a more predictive approach to orthopedic treatment.

The core value of this technology lies in real-time monitoring and long-term tracking, transforming implants from devices that merely provide fixation and support into tools that facilitate diagnosis and prevention. For surgeons, this data enables treatment strategies to be adjusted based on the patient’s actual condition. For patients, postoperative follow-up is no longer confined to periodic imaging; instead, they can continuously monitor the safety and performance of their implants.

Integrating sensors into Ti-6Al-4V titanium or PEEK materials demands highly precise manufacturing capabilities. This process encompasses sensor encapsulation, biocompatibility management, wireless transmission stability, battery longevity, and resistance to high-temperature sterilization. For Taiwanese OEM manufacturers, investing in smart implant technology represents not just a technological advancement but a strategic step toward entering the global high-end medical device supply chain. By combining innovation with consistent manufacturing quality, they can establish themselves as core suppliers for the next generation of orthopedic implants.

4Biodegradable Implant Materials

Bioresorbable implants are a pivotal technology revolutionizing orthopedic care. After implantation, these devices gradually degrade and are naturally absorbed by the body, typically within six to twenty-four months. This eliminates the need for a second surgery to remove the implant, thereby reducing patient discomfort and shortening the overall treatment timeline.

This technology is particularly well-suited for children and adolescent patients. Since their bones are still growing, traditional metal implants can interfere with development or necessitate multiple replacement surgeries. Biodegradable materials gradually dissolve as the bone grows, reducing the risk of foreign body complications and providing a treatment approach that aligns more closely with the body's natural healing process.

Bioresorbable implants are now widely used in fracture fixation, ligament repair, and sports medicine procedures. Clinical results demonstrate strong stability and favorable recovery outcomes. Although these materials are not yet suitable for high-load joint replacements, they have become the preferred option for many low- to medium-load surgeries. This technology is advancing orthopedic treatment toward minimally invasive approaches and regenerative medicine.

For medical device manufacturers and OEM suppliers, adopting biodegradable materials is more than a product upgrade; it entails significantly higher technical demands. These materials must be processed under precise temperature and environmental conditions to maintain their performance. Additionally, they must comply with stringent standards for biocompatibility and degradation rates. A manufacturer's capability to accurately form and finish these materials will directly influence its competitive standing in the future orthopedic market.

3. Material Properties and Applications of Orthopedic Implants

The long-term safety and performance of an implant within the human body depend not only on surgical technique but also on the materials used. Every advancement in materials science directly impacts the durability and functionality of orthopedic implants. For this reason, leading medical device manufacturers worldwide regard material development as a fundamental component of their competitive advantage.

From early stainless steel to today's widely adopted medical-grade titanium alloy Ti-6Al-4V, and now to the increasingly popular PEEK material, each new generation of implant materials has emerged to address real clinical challenges. Take hip joint implants as an example: early metal-on-metal designs could release trace amounts of metal ions due to long-term friction, sometimes causing adverse reactions in surrounding tissue. Modern designs now use wear-resistant ceramic components or specially reinforced plastic liners. These improvements reduce wear and extend the implant's lifespan.

In spinal fixation systems, PEEK is commonly used because its elasticity closely matches that of human bone. This compatibility allows the implant to distribute pressure more naturally, reducing the effects of stress shielding. Consequently, the surrounding bone bears the load more evenly, promoting a more physiological healing environment.

For Taiwanese medical device manufacturers, mastering a range of material processing techniques is essential to maintaining a competitive edge in the market. Titanium alloys require precise control of machining parameters, while PEEK is highly sensitive to temperature fluctuations. The quality of surface treatment directly affects the integration of bone with the implant. In fact, many failures in artificial knee implants result not from design flaws but from critical material handling details during manufacturing, seemingly minor issues that are vital for long-term success.

1The Value of Ti-6Al-4V Medical-Grade Titanium in Orthopedic Applications

Clinical Advantages of High Strength and Lightweight Properties

Ti-6Al-4V medical-grade titanium is the most widely used material for orthopedic implants worldwide due to its combination of high strength and lightweight properties. Its tensile strength can exceed 900 MPa, while its weight is approximately 60 percent that of stainless steel. This enables it to withstand long-term biomechanical loads while minimizing the physical burden on patients. Consequently, it is extensively used in long-term implant applications, such as artificial joints and spinal fixation systems.

This material exhibits excellent natural biocompatibility. When exposed to air, its surface forms a dense oxide layer that resists corrosion from bodily fluids and promotes bone integration. This enables the implant to establish a stable connection with the surrounding bone. Clinical data indicate that pedicle screws and rods made from Ti-6Al-4V have a long-term implant failure rate of less than 2 percent, demonstrating their stability and safety in clinical applications.

Material Properties Aligned with International Medical Standards

Medical-grade Ti-6Al-4V must comply with ASTM F136 or ISO 5832-3 standards, which specify stringent requirements for chemical composition, impurity levels, and mechanical properties. Oxygen and nitrogen content must be maintained at very low levels to preserve material toughness and fatigue resistance. Additionally, surface roughness must meet bone integration criteria, as surfaces that are either too rough or too smooth can adversely impact implant performance.

Advanced Machining and Surface Treatment Requirements

Titanium alloy machining demands tailored cutting parameters and cooling strategies based on the implant's geometry. For instance, femoral stems used in artificial hip joints undergo multiple stages of rough machining and finishing before surface treatments such as sandblasting and anodization are applied to enhance implant stability. If any process parameter is not meticulously controlled, it can lead to microcracks, thermal damage, or surface defects, adversely impacting the implant’s long-term clinical performance.

The Importance of Quality Control and Process Traceability

Implant failures are often attributed to issues in the manufacturing process rather than the materials themselves. Impurities in raw materials, machining damage, and inconsistent surface treatments can gradually cause loosening or fractures under long-term loading. Therefore, manufacturers with comprehensive quality management systems and full process traceability are essential to ensure the clinical safety and consistency of every implant.

2Clinical Advantages of PEEK (Polyether Ether Ketone)

Biomechanical Properties and Clinical Compatibility

PEEK (polyether ether ketone) is a high-performance, medical-grade polymer renowned for its elastic modulus, which closely matches that of human cortical bone. Its elasticity lies between that of metals and traditional plastics, enabling it to better replicate the body's natural load-bearing conditions. This property helps reduce stress shielding caused by excessively rigid implants and promotes normal bone loading and structural integrity.

Spinal Fusion: Applications and Clinical Performance

In spinal fusion procedures, PEEK cages have become a mainstream option. Clinical studies indicate that, compared to metal cages, implants made from PEEK can reduce adjacent segment degeneration by approximately 25%, thereby lowering the risk of revision surgery. Additionally, PEEK offers excellent radiolucency, enabling surgeons to monitor bone fusion after surgery clearly. This improves follow-up efficiency and reduces imaging costs.

Material Applications and the Development of Composite Design

PEEK is biocompatible and suitable for use in spinal fixation devices, craniofacial reconstruction, and sports medicine implants. However, because its strength is lower than that of titanium alloys, it is not appropriate for high-load applications such as femoral stems in hip replacements. To balance mechanical strength with biological performance, composite designs combining titanium and PEEK have emerged in the market, integrating the advantages of both materials.

Manufacturing and Surface Technology Requirements

Processing PEEK presents a technical challenge and requires precise control of cutting temperatures and parameters to prevent material degradation. Surface treatment is also a critical step, as implants often undergo sandblasting or other surface modifications to enhance bone integration. Some manufacturers have begun investing in PEEK 3D printing and carbon fiber–reinforced PEEK to improve performance further and increase design flexibility.

Market Trends and Technical Requirements for Manufacturers

As material technology advances, the clinical applications of PEEK are steadily expanding. For medical device OEM manufacturers, the capability to perform precision machining and surface treatment of PEEK has become a critical factor for entering the high-end spinal and regenerative medicine markets. Companies that master this material technology will achieve greater flexibility in product development and strengthen their competitive position in the global market.

3Applications of SUS316L Medical-Grade Stainless Steel

Material Properties and Medical Suitability

SUS316L is one of the most commonly used stainless steel materials in the medical field. The designation indicates its low carbon content, which helps maintain corrosion resistance after high-temperature welding and prevents carbide formation that could compromise material stability. With its excellent mechanical strength, biocompatibility, and cost-effectiveness, SUS316L is widely used in orthopedic applications, primarily for surgical instruments and short-term implant devices rather than long-term load-bearing implants.

Core Role in Surgical Instruments

SUS316L is widely used to manufacture auxiliary devices such as positioning tools, guides, and implant delivery instruments. These instruments must endure repeated manipulation and high torsional forces, as well as frequent exposure to high-temperature steam sterilization and chemical disinfection. Therefore, the material must offer both mechanical strength and corrosion resistance. SUS316L can be polished to achieve a surface roughness below Ra 0.2 micrometers, which helps reduce bacterial adhesion and enhances cleaning efficiency.

Applications in Short-Term Implants and Fixation Systems

In trauma repair, SUS316L stainless steel is commonly used to manufacture short-term implant devices such as bone plates and screws. This material offers mechanical reliability and is easy to process. These implants can be removed after bone healing, making them ideal for temporary fixation structures. Additionally, SUS316L costs approximately 30 to 40 percent of titanium alloy, helping to balance clinical effectiveness with medical expenses. As a result, SUS316L remains in high demand for external fixation devices and emergency treatment applications.

Limitations of Long-Term Implants

SUS316L has a lower strength-to-weight ratio compared to Ti-6Al-4V, and long-term implantation may lead to the release of metal ions such as nickel and chromium, which can cause allergic reactions or tissue irritation. For this reason, SUS316L is unsuitable for long-term implant applications, including artificial hip and knee joints or spinal fixation systems. These high-load implants have largely transitioned to materials such as titanium alloys and PEEK, which provide better biocompatibility and long-term performance.

Key Points in Manufacturing and Quality Control

Although SUS316L is considered a machinable material, its high toughness can lead to tool adhesion and surface burrs during processing. To meet medical-grade quality standards, manufacturers must employ appropriate tooling, optimize cutting parameters, and apply chemical passivation treatments. These processes ensure a clean surface free of cracks and contaminants. Additionally, all products must undergo comprehensive quality inspections and maintain full traceability management.

Overall, SUS316L remains a vital material in orthopedic surgical systems, primarily used for surgical instruments and short-term implants. For medical device manufacturers, mastering the machining and surface treatment of SUS316L is crucial to ensuring optimal clinical performance and maintaining high production efficiency. It is a core capability essential for delivering comprehensive orthopedic solutions.

4. The New Standard in Custom Manufacturing: A Comprehensive Process from Design to Production

Orthopedic implant manufacturing has evolved from using standard sizes to personalized designs. Previously, surgeons had to select from fixed implant sizes that were only approximate matches, potentially compromising postoperative stability and the implant's long-term performance. Thanks to advances in medical imaging and digital manufacturing technologies, implants can now be custom-designed using a patient's CT or MRI data, ensuring a more precise fit and improved clinical outcomes.

Phase One: Medical Imaging, Modeling, and Anatomical Analysis

The process begins with CT or MRI scans of the patient's bone structure. These scans produce three-dimensional images used to reconstruct the bone model. Engineers then analyze joint angles and load distribution to ensure the implant design aligns with the patient's unique anatomical characteristics.

Phase Two: Mechanical Simulation and Design Optimization (Finite Element Analysis)

In this phase, engineers use finite element analysis (FEA) to simulate how the implant responds to various movement conditions. This approach enables them to predict load distribution and identify areas prone to stress concentration or potential fractures. The optimized model improves implant stability and extends its service life. Clinical data indicate that fit accuracy can improve by approximately 30 percent, significantly reducing the risk of long-term loosening.

Phase Three: Precision Machining and Customized Manufacturing Techniques

Each implant is uniquely designed, and the manufacturing process must be customized for the individual model. CNC machining parameters and tool paths are programmed specifically for each implant to ensure that dimensions and surface quality meet medical standards. Unlike mass production, this approach demands greater manufacturing flexibility and technical precision.

Phase Four: Quality Traceability and Clinical Validation

For each implant, the material batch number, machining records, and inspection data must be thoroughly documented to ensure clinical safety and compliance with international regulatory standards. If postoperative tracking is required, the manufacturer can promptly identify the specific production process and implement corrective measures.

Clinical Benefits and Market Value of Customized Implants

Clinical results demonstrate that personalized implants can shorten surgical time, minimize bone removal, and enhance the range of motion. Patients experience a 30 to 40 percent reduction in average hospital stay. These benefits are particularly significant in complex procedures such as spinal fusion and revision surgeries.

For Taiwanese medical device manufacturers, this trend represents a high-value market opportunity. International brands are no longer seeking only machining capabilities; they now look for technical partners who can contribute to design, simulation analysis, and process traceability. Manufacturers with integrated expertise in imaging, 3D modeling, and precision machining will have a significant advantage in entering the global high-end medical device supply chain.

5. Applications of AI Technology in Orthopedic Implant Design and Surgical Planning

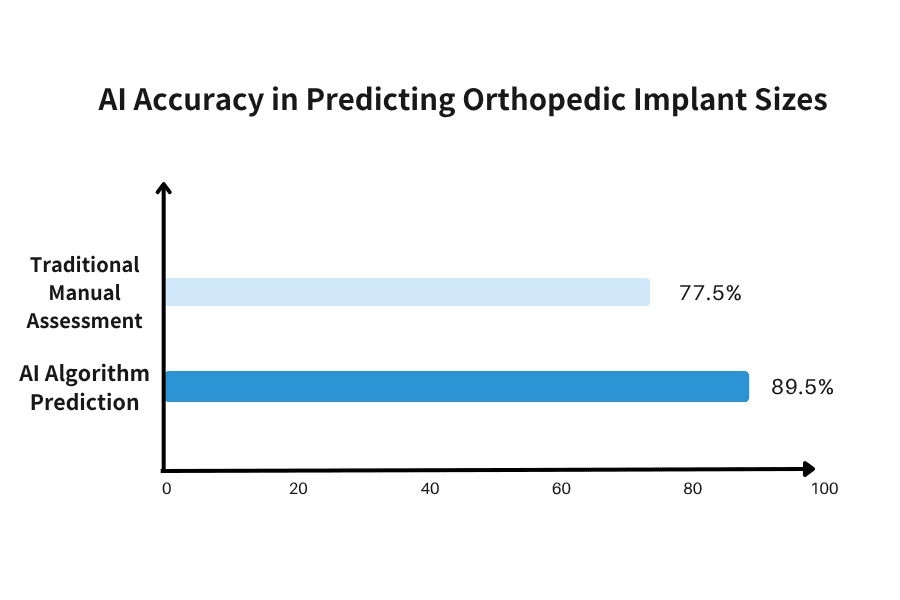

What if a computer could predict the ideal implant size for a patient before surgery with nearly 90 percent accuracy? This is no longer a hypothetical scenario. Artificial intelligence is revolutionizing the design of orthopedic implants and the planning of surgical procedures. According to a 2025 study by Mordor Intelligence, machine learning can predict the optimal implant size with an accuracy rate of 89.5 percent. In comparison, traditional manual assessments achieve an accuracy rate of 77.5 percent. This improvement of approximately 12 percent significantly reduces surgical risks and decreases the likelihood of revision surgeries.

Figure 2. Comparison of AI Algorithms and Manual Assessment Accuracy in Predicting Orthopedic Implant Size (Source: Mordor Intelligence, 2025).

Full-Process Application of AI Technology

In the past, implant size selection relied heavily on the surgeon's experience and interpretation of medical images, making accuracy dependent on individual judgment. AI technology now analyzes large volumes of clinical imaging data and historical surgical outcomes to calculate the optimal implant size and placement angle automatically. With a prediction accuracy of 89.5 percent, AI significantly outperforms traditional manual assessments. This data-driven approach is gradually replacing experience-based decision-making and is redefining orthopedic surgical planning.

During the product design phase, AI can analyze historical implant failure cases to identify high-risk design features proactively. Engineers can leverage AI-generated structural recommendations to optimize the model during the simulation stage, helping to prevent issues before the implant reaches clinical use. Clinical data indicate that incorporating AI-assisted design can reduce product development cycles by 30-40%.

With the integration of AI navigation systems in surgery, surgeons can perform implant placements guided by real-time prompts. The AI compares the patient's bone model with the implant design and provides precise quantitative guidance on angle and depth. Consequently, the placement deviation for total hip replacements can be controlled within plus or minus one degree, significantly enhancing long-term stability and extending the implant's lifespan.

In preoperative planning, AI can generate a 3D model and automatically measure bone dimensions immediately after imaging data is uploaded. This reduces planning time from the traditional 30 to 45 minutes to just 10 to 15 minutes. Rather than starting from scratch, surgeons can use the AI-generated recommendations as a foundation for clinical decision-making, enhancing both efficiency and accuracy.

Practical Benefits of AI Technology in Manufacturing

During the machining of Ti-6Al-4V medical-grade titanium, variations in cutting parameters directly impact product accuracy. AI systems can continuously monitor tool wear, feed rate, and coolant flow, automatically adjusting these parameters to maintain consistent quality. In PEEK processing, AI-powered visual inspection can detect microcracks and material deformations often missed by manual inspection, resulting in a significantly higher detection rate and enhanced manufacturing reliability.

Value of AI Technology in Manufacturing

For medical device manufacturers, adopting AI technology presents a significant opportunity to optimize processes. In the machining of Ti-6Al-4V alloys, AI can monitor cutting parameters in real time and make dynamic adjustments to enhance machining precision. In quality control for PEEK materials, AI-powered visual inspection systems can detect micro-defects that are challenging to identify through manual inspection. For OEM manufacturers in the medical device industry, developing AI capabilities will become a crucial competitive advantage in the future market.

Comparison of the Benefits of AI Adoption

|

Comparison Item |

Traditional Method | AI Technology | Improvement Rate |

|

Implant Size Prediction |

77.5% |

89.5% |

Accuracy improved by 12% |

| Preoperative Planning Time | 30 to 45 minutes | 10 to 15 minutes | Reduced by 60% to 70% |

| Implant Angle Precision | Within ±3 degrees | Within ±1 degree | Accuracy improved threefold. |

| Basis for Decision-Making | Personal experience and subjective judgment | Analysis of tens of thousands of clinical data points | Data-driven and quantifiable decision-making |

| Time to Detect Design Defects | Identified through years of clinical experience and feedback. | Predicted during the design phase | Significantly shortens the development cycle. |

| Quality Inspection Accuracy | Manual Visual Inspection | Higher Detection Rate | Higher Detection Rate |

Table 1. Comparison of Traditional Methods and the Benefits of AI

AI technology is evolving from a supportive tool into a core driver of the orthopedic medical device industry. It not only enhances the accuracy of clinical decision-making but also fundamentally transforms product design and manufacturing processes. For medical device manufacturers, adopting AI is no longer optional; it has become a critical threshold that determines global competitiveness. Companies that leverage AI to develop data-driven decision systems and real-time process controls will be well-positioned to capture the high-end medical device market.

The value of AI lies not in replacing human expertise but in enhancing the overall quality of decision-making and establishing an intelligent management framework that integrates both clinical and manufacturing aspects. As data volumes grow and algorithms advance, AI will become the driving force behind the next phase of development in the orthopedic implant industry. Additionally, it will serve as a critical capability for OEM manufacturers aiming to enter the high-end medical device market.

6. Global Market Analysis: Regional Growth Opportunities and Emerging Trends

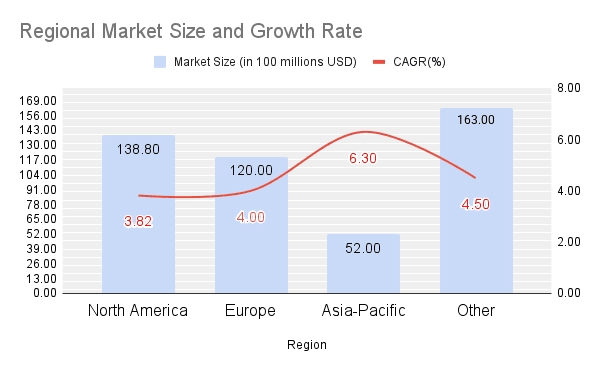

The global orthopedic implant market is experiencing a strategic shift, presenting unprecedented opportunities for manufacturers in Asia. According to data from Precedence Research, the North American market reached USD 13.88 billion in 2024 and is projected to grow steadily at a compound annual growth rate (CAGR) of 3.82% through 2025. More notably, the Asia-Pacific region is witnessing accelerated growth. A 2024 report by Data Bridge Market Research projects the Asia-Pacific market to reach USD 8.48 billion by 2031, with a CAGR of 6.3%, surpassing traditional markets and highlighting significant opportunities for regional manufacturers.

Figure 3. Regional Market Size and Growth Rate Analysis of the Global Orthopedic Implant Market. Source: Precedence Research (2025), Data Bridge Market Research (2024).

Several key factors are driving this trend. First, healthcare infrastructure in emerging markets is rapidly improving. Countries such as India, Thailand, and China are experiencing significant growth in medical tourism, attracting international patients seeking advanced orthopedic procedures, including joint replacement surgeries. Second, population aging is becoming increasingly prominent in Asia, fueling strong demand for hip implants, knee implants, and spinal fixation systems. Third, breakthroughs in manufacturing technology are further accelerating market growth. According to Precedence Research, the 3D-printed medical implant market is projected to grow from USD 2.24 billion in 2024 to USD 9.81 billion by 2034, with a compound annual growth rate (CAGR) of 15.91%, clearly demonstrating the strong potential of customized manufacturing.

For Taiwanese OEM manufacturers, this presents a significant strategic opportunity. With proven expertise in medical-grade titanium machining and precision manufacturing, along with geographical proximity to the Asia-Pacific market, Taiwanese medical device manufacturers are well-positioned to assume a leading role in this growth cycle. However, capitalizing on this opportunity depends on selecting the right strategic partners who can drive innovation and support sustainable long-term market expansion.

7. Six Common Challenges in Orthopedic Implant OEM Manufacturing: From Material Selection to Regulatory Approval

1. Why do orthopedic implants require customized designs?

Every patient has unique anatomical structures and physiological conditions, meaning that standard implant sizes may not provide an ideal fit. By utilizing 3D printing and advanced medical imaging technologies, implants can be custom-designed to match individual anatomy. This approach improves surgical stability, enhances recovery outcomes, and reduces the risk of complications.

2. Which material is better for orthopedic implants: titanium alloy or PEEK?

Titanium alloy (Ti-6Al-4V) offers high strength and excellent corrosion resistance, making it ideal for load-bearing implant components. PEEK exhibits elasticity closer to that of human bone and is radiolucent, enabling surgeons to clearly monitor bone healing through imaging. The optimal material choice depends on the surgical site, load requirements, and specific clinical objectives.

3. What Key Capabilities Should You Consider When Selecting an OEM Manufacturer for Orthopedic Medical Devices?

When evaluating an OEM partner for medical device manufacturing, it is essential to focus on several key capabilities. First, assess their material processing expertise, including experience with medical-grade titanium machining (Ti-6Al-4V), PEEK processing, and precision stainless steel manufacturing. Second, evaluate their quality management system by confirming ISO 13485 certification and the implementation of a comprehensive traceability system. Third, consider their innovation capabilities, such as proficiency in advanced technologies like 3D printing and surface modification. Taiwanese OEM manufacturers are renowned for their strengths in precision machining and quality control, making those with a fully integrated technical chain strong candidates for strategic partnerships.

4. How Is Quality Ensured in the Manufacturing of Orthopedic Implants?

Every stage of the manufacturing process is conducted in accordance with the ISO 13485 medical device quality management system. From raw material inspection and machining control to surface treatment and final testing, each step is thoroughly documented and traceable to ensure compliance and safety.

Through high-precision measurement and comprehensive quality verification, manufacturers can guarantee product consistency, long-term reliability, and clinical performance for every batch.

5. What Are the Key Future Directions in the Orthopedic Manufacturing Industry?

The orthopedic manufacturing industry is expected to evolve in three primary directions:

- Smart manufacturing and automation enhance machining accuracy and increase production efficiency.

- Sustainable and eco-friendly manufacturing involves adopting energy-efficient equipment and reducing material waste.

- Personalized medicine combines 3D printing with AI-driven design to deliver more precise implant solutions.

These trends will propel the global medical device supply chain into a new era characterized by higher quality and enhanced efficiency.

6. How Long Does It Take for an Orthopedic Implant to Go from Design to Market?

The timeline varies depending on product complexity and regulatory requirements. For implants utilizing new materials or advanced technologies such as 3D printing, a comprehensive ISO 10993 biocompatibility assessment is required. This assessment includes more than ten types of evaluations, such as cytotoxicity, sensitization, and implantation testing. The entire validation process can take between 18 and 24 months. For existing products with only design modifications, the timeline may be shortened to 6 to 12 months. One of the key advantages of customized 3D-printed implants is that once the core design is approved, patient-specific implants can be produced in less than two weeks.

8. Conclusion: Advancing Medical Device Manufacturing Through Innovation and Sustainability

Industry Transformation and Future Outlook

The global orthopedic implant market is projected to grow from USD 49.73 billion in 2025 to USD 71.74 billion by 2032. This growth reflects not only an expanding market size but also a significant technological transformation occurring across the industry. The sector is transitioning from standardized production to personalized precision medicine and from traditional material processing to intelligent system integration. Orthopedic implant manufacturing is entering a new phase characterized by smart technology and sustainability.

This transformation is evident at every level of the value chain. Additive manufacturing (3D printing) has made customized joint implants a viable solution. AI algorithms now achieve implant size prediction accuracy of up to 89.5 percent. Advances in processing PEEK and Ti-6Al-4V titanium alloy are enabling implants that more closely replicate human biomechanics. Sustainable manufacturing practices have increased material utilization rates from 60 percent to 80 percent. These innovations are not only enhancing product quality but also redefining the fundamental value of medical device manufacturing.

For medical device companies, selecting a manufacturing partner is no longer solely about current capabilities. It involves choosing a long-term collaborator who can continuously innovate and remain aligned with industry advancements. Future orthopedic products will be founded on three core pillars: personalization, safety, and sustainability. Supported by advanced technologies, these products will provide more precise and effective solutions that improve patient outcomes and redefine standards in global healthcare.

Partnering with YSF Medical to Shape the Future of Orthopedic Innovation

YSF Medical has over 30 years of experience in precision manufacturing, specializing in OEM services for medical devices. We possess comprehensive capabilities in machining medical-grade titanium and expertise in processing a wide range of advanced materials. We recognize that quality and reliability are critical in contract manufacturing for medical devices. From material selection and process control to final inspection, every stage is conducted under a rigorous quality management system to ensure product safety, consistency, and full traceability.

- Precision Machining of Ti-6Al-4V Medical-Grade Titanium

- Processing of PEEK (polyether ether ketone) Materials

- Precision Manufacturing of SUS316L Stainless Steel

- Multi-axis CNC turning and milling technologies

- Comprehensive Process Quality Traceability System

If you are seeking a Taiwanese OEM partner to support product innovation and ensure consistent quality, we invite you to contact us. Please complete the inquiry form or email us at sales@ysfbone.com. Our professional team will respond within 24 hours.

9. Disclaimer

This content is intended for reference by medical professionals and the healthcare industry. Some information is sourced from publicly available materials or expert opinions and may be incomplete or require further verification. Feedback and professional discussion are encouraged.

Important Reminder: Any medical diagnosis or treatment decisions should be based exclusively on the professional judgment of qualified clinicians. Patients should not make medical decisions solely on the information provided in this document.

10. References

Data Bridge Market Research. (2023, September 20). Personalized 3D printed orthopedic implants market – global market – industry trends and forecast to 2030.

https://www.databridgemarketresearch.com/reports/global-personalized-3d-printed-orthopedic-implants-market

Data Bridge Market Research. (2024). Asia-Pacific orthopedic implants market size & statistics by 2031.

https://www.databridgemarketresearch.com/reports/asia-pacific-orthopedic-implants-including-dental-implants-market

Fortune Business Insights. (2024). Orthopedic implants market size, share & forecast report [2032].

https://www.fortunebusinessinsights.com/industry-reports/orthopedic-implants-market-101659

Markets and Markets. (2025). Orthopedic implants market size & growth forecast to 2029.

https://www.marketsandmarkets.com/Market-Reports/orthopedic-implants-market-5230937.html

Mordor Intelligence. (2025, June 26). Orthopedic devices market size, share, growth & industry trends outlook, 2030.

https://www.mordorintelligence.com/industry-reports/global-orthopedic-devices-market-industry

Precedence Research. (2024). 3D printing medical implants market size to hit USD 9.81 Bn by 2034.

https://www.precedenceresearch.com/3d-printing-medical-implants-market

Precedence Research. (2025). Orthopedic implant market size and forecast 2025 to 2034.

https://www.precedenceresearch.com/orthopedic-implant-market

Technavio. (2025). Orthopedic 3D printed devices market growth analysis – size and forecast 2025–2029.

https://www.technavio.com/report/orthopedic-3d-printed-devices-market-industry-analysis

Yahoo Finance. (2025, May 2). Orthopedic implants market and companies overview 2025: A $32.4 billion competitive landscape by 2030.

https://finance.yahoo.com/news/orthopedic-implants-market-companies-overview-080900078.html

International Organization for Standardization. (2018). ISO 10993-1:2018 Biological evaluation of medical devices — Part 1: Evaluation and testing within a risk management process.

https://www.iso.org/standard/68936.html

Trovarelli, G., Cappellari, A., Ruggieri, P., & Porcellini, G. (2020). Changing device regulations in the European Union: Impact on research, innovation and clinical practice. EFORT Open Reviews, 5(3), 126-134. https://doi.org/10.1302/2058-5241.5.190024

TÜV SÜD. (n.d.). ISO 13485 medical device quality management.

https://www.tuvsud.com/en/services/product-certification/ps-cert/ps-cert-medical-devices/iso-13485

U.S. Food and Drug Administration. (n.d.). Premarket notification 510(k).

https://www.fda.gov/medical-devices/premarket-submissions-selecting-and-preparing-correct-submission/premarket-notification-510k

© 2025 YSF Medical Enterprise Co., Ltd. | Experts in Orthopedic Implants and Surgical Instruments Manufacturing | ISO 13485-Certified Medical Device Manufacturer | Precision CNC Machining | All rights reserved. Please cite the source when quoting or reproducing any content.

.webp) Contact Us

Contact Us

.webp) CONTACT US

CONTACT US